💙🧡 Preparation to migrate to the NEW Recurring API

Integration Availability: The NEW Recurring API is available since March 12th. Email developer@vippsmobilepay.com for help.

Documentation and Changelogs

API Reference: Explore the documentation for the New Recurring API.

API Documentation: Find detailed information on the New Recurring API.

Changelogs: All changes to the Recurring API.

Testing the API

Test the new Recurring API in the merchant test environment. Recreate your test data as previous data won’t be migrated. Use the new Access Token API; old tokens are invalid post-launch. If you want to test the Mobilepay Subscriptions facade instead please read here.

Please note:

- You must recreate your Subscriptions test data as previous data (agreements, payments, refunds, etc.) won't be migrated to the Recurring merchant test environment.

- Integrate with the new Access Token API. Old MobilePay-issued tokens are be invalid post-Nordic Wallet launch. Access Token API Guide

The Merchant Test (MT) environment is now open for testing. See limitations of the test environment for more details.

Request Access

You'll receive an email with the required information, even if you're an existing integrator or merchant.

1. Agreements

1.1 Agreement Identifier

-Change: Agreement main identifier is agreementId. Example of id: agr_e5Gd2fIjr

-Recommendation: We strongly recommend to use the agreementId instead of the uuid when transitioning to the recurring-api. While it is possible for merchants to fetch agreement by uuid or fetch charge using agreement uuid, it is less efficient and slower than fetching by id. This approach also eliminates the need for you to keep a mapping between uuid and agreementId. Read more about agreements in recurring in the api guide.

1.2 Agreement Request Expiration

- Change: Signing period will be reduced to 10 minutes after Nordic Wallet Launch. Existing agreements with longer expiration will expire on launch day.

- Recommendation: Create a middle layer to handle agreement requests on your infrastructure, allowing more than 10 minutes for signing. This reduces unnecessary data and GDPR concerns.

- Tech:

- API Endpoint:

POST:/api/providers/{providerId}/agreements - Parameter:

expiration_timeout_minutes(will always be 10 minutes post-launch).

- API Endpoint:

1.3 Agreement Deletion Validations

- Change: Preventing customer cancellations within 24 hours will be unavailable after Nordic Wallet Launch.

- Recommendation: Provide a seamless payment experience to avoid cancellations.

- Tech:

- API Endpoint:

POST:/api/providers/{providerId}/agreements - Parameter:

retention_period_hours(will be ignored post-launch).

- API Endpoint:

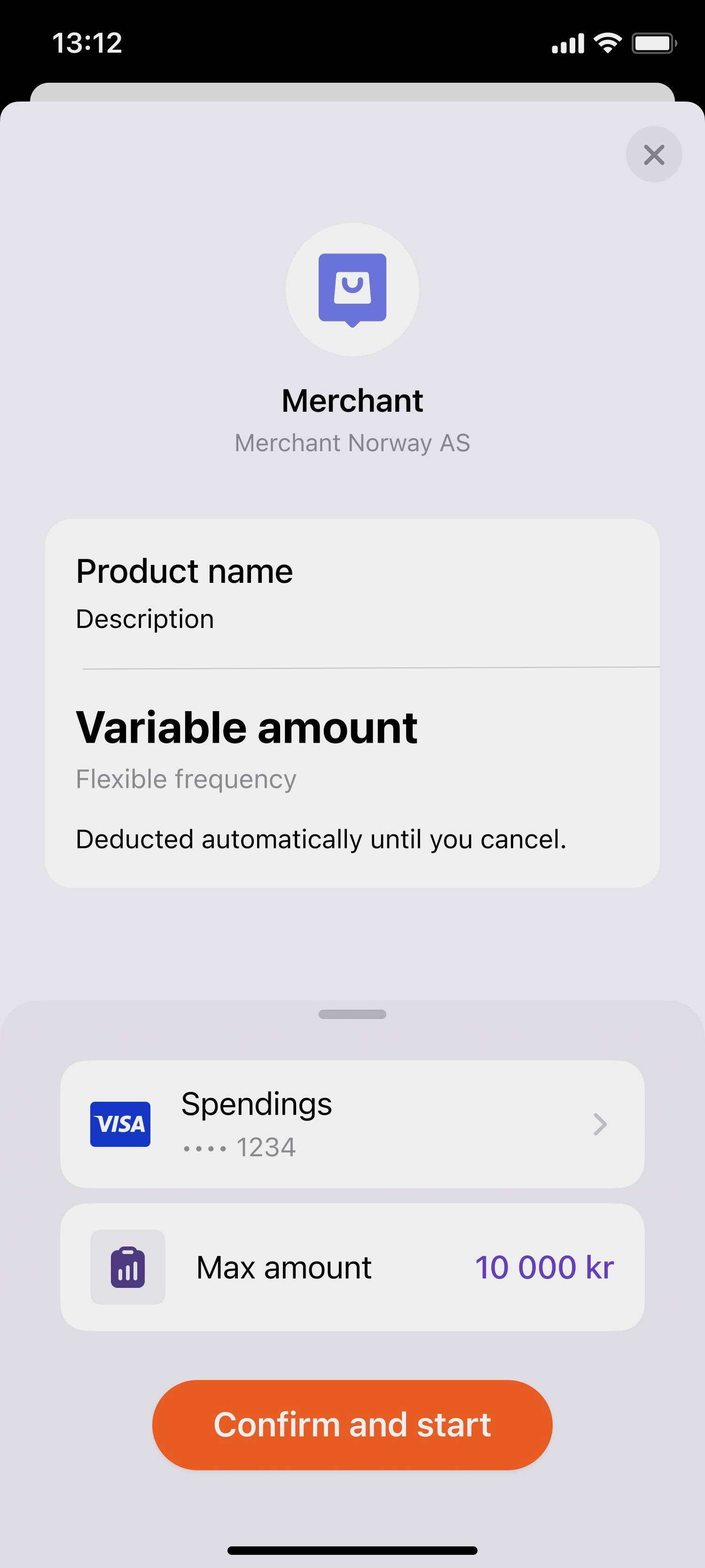

1.4 Agreements Without Amount

- Change: Agreements without a stated amount will be considered variable amount agreements.

- Recommendation: Update/create agreements with known amounts.

- Tech:

- API Endpoint:

POST /api/providers/{providerId}/agreementsorPATCH /api/providers/{providerId}/agreements/{agreementId} - Parameter:

amount

- API Endpoint:

1.4 Agreement Cancellation by Merchant

- Change: Canceling agreements will also cancel any reserved payments post-launch.

- Recommendation: Capture reserved payments before canceling agreements if applicable.

2. Recurring payments

2.1 Payments visible 8 days in advance

We want to empower you with transparency and flexibility when it comes to your recurring payments. Currently, your customer can view upcoming payments in the app up to 8 days in advance, regardless of whether the payment was sent 30 or 60 days earlier. However, from Nordic Wallet Launch, we're excited to announce that customers will be able to see your upcoming payment 35 days in advance if you send it that early.

⭐ Recommendation: If 35 days of payment visibility in the app is too long for you, we recommend sending a payment closer to the due date.

2.2 Update existing payment

Error in the payment you sent to your customer? From Nordic Wallet Launch, we ask you to update existing payments in a slightly different way.

⭐ Recommendation: We recommend that you cancel existing payments and create brand-new ones in cases when payment information needs to be updated.

⚙️ Tech: API endpoint: PATCH:/api/providers/{providerId}/agreements/{agreementId}/paymentrequests/{paymentId} will be unavailable from Nordic Wallet Launch.

2.3 Push message for the user

Currently, your customers are receiving push messages 1 day in advance about upcoming recurring payments. You have the option to manage this notification through Subscription APIs. From Nordic Wallet Launch, we are removing this push notification for your customers, and push management will stop being relevant, too. But do not worry, customers choosing to get those push messages will be informed about executed payments instead; in addition to notifications about all failed payments where they need to change a card, increase funds, etc.

⭐ Recommendation: Sit back and relax, we will make sure that all payments are executed successfully.

⚙️ Tech: API endpoint: POST:/api/providers/{providerId}/agreements

Parameter: disable_notification_management, notifications_on will be ignored from Nordic Wallet Launch.

2.4 Invalid recurring payments

This one is a bit more technical. ⚙️ Currently, we are saving every payment request you send to us, even Invalid ones. You can check the whole status diagram here. From Nordic Wallet Launch, we will stop storing these requests. This will not impact payment validation or payment execution logic. You will still get callbacks about payment status changes.

3. One-off payments

3.1 One-off payments types

One-off payments in Subscriptions were used in 3 different ways:

- Create a new Agreement with an initial One-Off Payment. ✅ Will continue.

- Customer can initiate and request arbitrary One-Off Payment payments on their existing Agreement. ❌ Will be terminated.

- Merchants can send One-Off payment, which MobilePay will attempt to automatically reserve, without user’s confirmation. ✅ Will continue.

We reevaluated all our product packages, that from Nordic Wallet Launch, flow 2 will be moved from Subscriptions (Recurring) product to another Vipps MobilePay product - ePayment! 🍀 Basically, all payments which are merchant initiated (MIT) and do not require Strong Customer Authentication (SCA) stay in Subscriptions and also Recurring. All payments where SCA is needed will be in ePayment product.

⭐ Recommendation: If you want to continue charging your customers with payments where SCA is needed, please reintegrate these types of payments to Vipps MobilePay ePayment.

3.2 One-off expiration period

Similarly, as with agreements, we are aligning the expiration period for one-off payments. From Nordic Wallet Launch, the expiration timeout for:

- one-off with a new agreement will always be 10 minutes.

- one-off for an existing agreement will always be 1 minutes. All one-offs with longer expiration time will be expired on Nordic Wallet Launch day.

⭐ Recommendation:

- Flow 1: Create a new Agreement with an initial One-Off Payment. Just set the same expiration period subtracting for the one-offs as you set for agreements. You can read about changes in agreements here.

- Flow 3: Merchants can send a One-Off payment, which MobilePay will attempt to automatically reserve, without the user’s confirmation. The long expiration time is not relevant for one-off auto reservation payments. So all is good here 😉.

⚙️ Tech: API endpoint: POST:/api/providers/{providerId}/agreements POST:/api/providers/{providerId}/agreements/{agreementId}/oneoffpayments

Parameter: expiration_timeout_minutes, one_off_payment.expiration_timeout_minutes Current range from 1 to 181440 min, the default was 10 minutes. After Nordic Wallet Launch, the expiration time will always be:

- 10 minutes for one-off when it's with new agreement

- 1 minutes for one-off created when it's for an existing agreement

3.3 Description of a one-off with a new agreement

Currently, in Subscriptions, the Description field for one-off which is created together with the new agreement is not mandatory. We are changing that and making it a required field.

⭐ Recommendation: When creating a one-off payment with a new agreement provide a Description, but if you will forget, do not worry, we will prefill it with "Initial charge".

⚙️ Tech: API endpoint: POST /api/providers/{providerId}/agreements

Parameter: one_off_payment.description

4. Refunds

In general: it is possible to do GET requests for pre-launch refunds. Furthermore, it is also possible to make refunds for pre-launch payments. Please note: We can only handle 30 days backward for pre-launch payments, whereas we can handle 365 days backward on the new platform, if the payment is completed on the new platform GET requests and refunds (up to 30 days) can be made for payments executed on the existing MobilePay platform

4.1 Refund up to 365 days

Currently, you can refund payments that were executed up to 90 days in the past. Good news! We will give you an amazingly long period to refund your payments on One Platform - 365 days! ⚡️ The new period will be applied only to payments that will be executed on the new platform after Nordic Wallet Launch.

- Payments made on the old platform starting from March 12th 2024 have a refund window of 30 days.

- Payments made on the new platform have a refund window of 365 days.

4.2 Refunds description

In Subscriptions, Refunds had no Description, but in the new Recurring setup, this field is present and mandatory. We will prefill it with a simple "Refund" for you.

4.3 Refund responses

There will be no callbacks anymore for refunds after Nordic Wallet Launch. All needed information will be handled through API response.

Note: For payments made before Nordic Wallet Launch, status_callback_url will still be required and callbacks will still be sent. For payments made after Nordic Wallet Launch, the Facade will return the status_callback_url, although it will not be utilized in the backend logic since callbacks for refunds will no longer be present.

⭐ Recommendation: If you use refunds review planned API responses and adjust your integration to handle it.

⚙️ Tech:

{

"id": "d5f51369-5c3b-4246-958e-9aefeb2ac5fe",

"amount": 500,

"external_id": "AA3F5Y6G4",

"status_callback_url": "https://merchantProviderUrl.com/refund"

}

{

"StatusCode": 100,

"StatusText": "Something went wrong while refunding charge"

}

{

"StatusCode": 101,

"StatusText": "Cannot refund a charge older than 365 days"

}

{

"StatusCode": 102,

"StatusText": "Cannot modify an agreement which is not active"

}

{

"StatusCode": 103,

"StatusText": "Invalid status"

}

{

"StatusCode": 104,

"StatusText": "Invalid amount, you cannot refund more than the remaining value on this charge/payment"

}

5. App 📱

5.1 Merchant visibility

The list of potential merchants is no longer be displayed in the app. However, all active and stopped agreements will still be readily visible to the app users.

5.2 Merchant information on agreements

Currently, you are able to show your contact information in every agreement for your customer in the agreement Info tab: Website, Customer Support, Self Service, FAQ. From Nordic Wallet Launch, this contact information will no longer be displayed for the user.

⭐Recommendation: You can always provide an agreement management URL to the user (we call it cancel-redirect in our documentation) which enables them to reach your environment from the app. Or you could add contact information in the agreement description if this is necessary.

6. Payment attachments

Read more here.

6.1 PDF generation

We have decided to focus more on payment execution and agreement signing success rather than PDF generation capabilities. So, the PDF generation option will no longer be available from 12th of March.

⭐Recommendation: We hope you will find other ways to send PDF documents to your customers.

⚙️ Tech: API endpoint: PUT:/api/providers/{providerId}/payments/{paymentId}/attachment

Parameter: generate_pdf : true will be ignored from Nordic Wallet Launch.

6.2 External URL

Before the 12th of March, we provided the possibility for you to update your Subscription payment with extra attachments like External URL. We will not be able to re-introduce this feature from the moment of Nordic Wallet Launch

⚙️ Tech: API endpoint: PUT:/api/providers/{providerId}/payments/{paymentId}/attachment

Parameter: external_attachment_url

6.3 Attachment details

Similarly, as with External URL, we will not make it to re-introduce this feature from the moment of 12th of march. We promise to work on it as soon as possible and introduce the feature right after Launch.

⚙️ Tech: API endpoint: PUT:/api/providers/{providerId}/payments/{paymentId}/attachment

Parameter: attachment_details

7. Onboarding

7.1 Authorisation

For merchants

- If you will need to restart the consent flow, e.g. get a new refresh token after Nordic Wallet Launch, you will have to do that already though new Vipps MobilePay platform.

- If you are planning to start using Recurring on the New Vipps MobilePay platform, just integrate into the new setup from the beginning.

Read more about Access token API guide.

For integrators/partners

- If you are planning to start using Recurring on New Vipps MobilePay platform, just integrate to the new setup from the beginning.

- If you are an existing partner in Subscriptions on the MobilePay platform and you want to onboard new merchants, we will ask you to change your authorization setup. From the Nordic Wallet Launch, we will not be able to support the existing flow where the merchant grants consent to you. Access and refresh tokens that were issued before the transition will remain valid and continue to work. To get providerId for new onboarded merchants, you can call

GET:/api/merchants/mewith the new authorization token andMerchant-Serial-Numberheader.

- Read more about Access token API guide and Technical information for partners.

8. Settlements

8.1 From the Nordic Wallet Launch all sales units (payment points) will be switched to daily settlements

Currently you were able to select how to receive settlements: daily or instant. After NWL all sales units will be switched to receive daily settlements. Instant transfers will stay as a functionality, but it will be renamed to Single payment settlements, which represents the functionality in better way. Furthermore, functionality will be for an extra fee. With Single payment settlements every payment will be settled separately (not bundled up) and you will receive it in 1 days after payment was executed.

⭐Recommendation: If you need to have your payments settled separately, log in to new Merchant Portal after NWL and select Single payment settlement functionality.

9. Other

9.1 Callback changes for recurring and one-off payments

We will stop sending our old callbacks for one-off payment expiration and rejection by users from Nordic Wallet Launch.

Instead we will start sending new callback for both recurring and one-off payment:

[

{

"agreement_id": "d230e533-dceb-483b-a9ce-cf99e7851d0e",

"payment_id": "86957d1c-00f5-4b9c-bd29-dd2e8de082d8",

"amount": "54.00",

"currency": "DKK",

"payment_date": "2023-08-24",

"payment_type": "OneOff",

"status": "Cancelled",

"status_text": "Payment cancelled.",

"status_code": 70003,

"external_id": "ed40a2e7-a14b-44c8-a35d-ec015e6d31f0"

}

]

[

{

"agreement_id": "d230e533-dceb-483b-a9ce-cf99e7851d0e",

"payment_id": "86957d1c-00f5-4b9c-bd29-dd2e8de082d8",

"amount": "54.00",

"currency": "DKK",

"payment_date": "2023-08-24",

"payment_type": "Regular",

"status": "Cancelled",

"status_text": "Payment cancelled.",

"status_code": 70003,

"external_id": "ed40a2e7-a14b-44c8-a35d-ec015e6d31f0"

}

]

Above callbacks will be sent in following cases:

- For each pending recurring payment which is cancelled due to users' initiated cancellation of agreement

- For each pending recurring payment which is cancelled due to merchants' initiated cancellation of agreement

- For merchants' initiated cancellation of pending recurring payment

- For each one-off payment expiration

- For each one-off payment rejection by user

- For each cancellation of pending one-off payment, due to merchants' initiated cancellation of pending agreement

9.3 Callbacks for non reintegrated merchants after NWL

These are the callbacks we will be sending for non reintegrated merchants.

Agreement callbacks (no changes):

| Status | Status code | Status text |

|---|---|---|

| Accepted | 0 | The agreement has been accepted. |

| Expired | 40001 | Pending agreement expired. |

| Rejected | 40000 | Rejected by user. |

| Canceled | 40002 | The agreement was canceled by the user. |

| Canceled | 40003 | The agreement was canceled by the merchant. |

Recurring payment callbacks:

| Status | Status code | Status text | Callback sending condition |

|---|---|---|---|

| Cancelled | 70003 | Payment cancelled. | Pending payment cancelled due to user cancelling an agreement |

| Pending payment cancelled due to merchant cancelling an agreement | |||

| Merchants' initiated cancellation of pending recurring payment | |||

| Executed | 0 | null | Payment successfully executed on due date |

| Failed | 50000 | See note below | Payment failed to execute during the due date |

| Declined | 70001 | Payment amount is 5 times higher than agreement amount. | Payment batch request contains a payment which amount is 5 times higher than |

| agreement's amount. Applicable when agreement has an amount more than 0 | |||

| Declined | 50003 | Declined by system: Agreement is not in \"Active\" state. | Payment batch request contains a payment for non-active agreement |

| Declined | 50004 | Declined by system: Found duplicates for the same DueDate and AgreementId/ExternalId. | Payment batch request contains a duplicate payment with the same DueDate and AgreementId/ExternalId |

| Declined | 50006 | Declined by system. | Unspecified error when processing payment from payment batch request |

Please note:

Recurring payment callback with status Failed and status code 50000 will be sent with different status text, depending on the reason for the recurring payment failure. For more information, please refer to https://developer.vippsmobilepay.com/docs/APIs/recurring-api/recurring-api-guide/#charge-failure-reasons.

Please also note that the charge_amount_too_high failure reason is not applicable to non-reintegrated merchants.

One-off payment sent with an agreement:

| Status | Status code | Status text | Callback sending condition |

|---|---|---|---|

| Cancelled | 70003 | Payment cancelled. | Pending agreement with one-off payment has expired |

| Pending agreement with one-off payment was rejected by user | |||

| Merchant cancels pending agreement with one-off payment | |||

| Merchant cancels active agreement and one-off payment is Reserved | |||

| Merchant cancels Reserved one-off payment | |||

| Reserved | 0 | Payment successfully reserved. | Agreement with one-off payment was accepted and payment was reserved |

Autoreserve one-off payment:

| Status | Status code | Status text | Callback sending condition |

|---|---|---|---|

| Cancelled | 70003 | Payment cancelled. | Merchant cancels autoreserve one-off payment in Requested or Reserved status |

| Merchant cancels active agreement and one-off payment is Reserved or Requested | |||

| Payment expires | |||

| Reserved | 0 | Payment successfully reserved. | Payment reserved |

| Requested | 50013 | Automatic reservation failed. User action is needed. | Reservation failed |

In the new platform reservation failure and expiration callbacks are sent only after payment expiration with few seconds delay between each other.

9.4 Callbacks for reintegrated merchants

When you are reintegrating, you will use Webhook solution https://developer.vippsmobilepay.com/docs/APIs/webhooks-api/ By default after integrating with new Webhook solution, you will still receive old payment callbacks to your old payment callback URL and there is no possibility to change callback url or authentication method for old integration. This means that you will receive both old callbacks and new webhooks. Once you have integrated towards Webooks and no longer rely on old callbacks, please notify us and we will turn them off.

Here you can find a payload and other useful information about new Webhooks https://developer.vippsmobilepay.com/docs/APIs/recurring-api/recurring-api-guide/#webhooks-integration

9.5 Error messages

We are making adjustments to error responses, specifically related to error_description.message and error_description.error_type. Some values will remain unchanged, some will be modified, and new validations will be introduced. Some messages may be less explicit than before, as they are generated directly from the backend and not specifically tailored for exact app branding (MobilePay or Vipps) responses.

Example:

{

"error": "BadRequest",

"error_description": {

"message": "The field 'phoneNumber' has an invalid format for a phone number, provided value: '44444444444444'",

"error_type": "InputError",

"correlation_id": "ef928510-ae19-4fe7-ae1e-76b43de202f5",

"error_code": null,

"localized_message": "A technical error occurred."

}

}

Some field names, like mobile_phone_number, will undergo changes; for instance, it will be referred to as phoneNumber. If clarity is needed, refer to Recurring documentation for field specifications.

⭐ Recommendation: Avoid relying on specific values in error_description.message and error_description.error_type. Update your error handling processes to ensure flexibility in these two fields.

9.6 Rate limiting

We have rate limiting in place for each endpoints of the facade. For simplicity reasons, we have put in place the same policies as the recurring-api for most of the endpoints.

| Endpoint | Limit |

|---|---|

POST api/providers/{providerid}/agreements | 300 per minute per provider |

GET api/providers/{providerid}/agreements | 5 per minute per pageNumber and pageSize combination |

GET api/providers/{providerid}/agreements/{agreementId} | 120 per minute per agreementId |

PATCH api/providers/{providerid}/agreements/{agreementId} | 5 per minute per agreementId |

DELETE api/providers/{providerid}/agreements/{agreementId} | 5 per minute per agreementId |

POST api/providers/{providerid}/paymentrequests | 400 per minute per provider |

GET api/providers/{providerid}/agreements/{agreementid}/paymentrequests | 10 per minute per agreementId |

GET api/providers/{providerid}/agreements/{agreementid}/paymentrequests/{paymentId} | 10 per minute per paymentId |

POST api/providers/{providerid}/agreements/{agreementid}/oneoffpayments | 300 per minute per provider per agreementId |

GET api/providers/{providerid}/agreements/{agreementid}/oneoffpayments | 10 per minute per provider per agreementId |

GET api/providers/{providerid}/agreements/{agreementid}/oneoffpayments{paymentId} | 10 per minute per oneoffpaymentId |

POST api/providers/{providerid}/agreements/{agreementid}/oneoffpayments{paymentId}/capture | 5 per minute per oneoffpaymentId |

DELETE api/providers/{providerid}/agreements/{agreementid}/oneoffpayments{paymentId} | 5 per minute per oneoffpaymentId |

POST api/providers/{providerid}/agreements/{agreementid}/oneoffpayments{paymentId} | 5 per minute per oneoffpaymentId |

GET api/providers/{providerid}/agreements/{agreementid}/payments/{paymentid}/refunds | 10 per minute per paymentId |

POST api/providers/{providerid}/agreements/{agreementid}/payments/{paymentid}/refunds | 5 per minute per paymentId |

10. Test

The first version of the new test environment is ready for the Subscriptions facade. All features are available.

10.1 Test credentials

Test merchant: Find a guide to create test merchant here. The test credentials consist of a client id, client secret and subscriptions key.

Test user: Find a guide to create test users here

For partners: Please contact partner@vippsmobilepay.com to request a DK or FI test merchant and user.

Please note: If you want to reuse your Subscriptions test data you will need to recreate your test data. Please note that all test data, including payments, refunds, and so on, created on the old platform will not be migrated from the sandbox to the merchant test environment.

10.2 Authentication

You will have to integrate with the new and simplified Access Token API designed for the merchant test environment. The old MobilePay OpenId consent flow for the sandbox will cease to function. Access token API guide.

10.3 Headers and endpoints

You must include these headers for all requests to the API

-H 'Authorization: Bearer {JWT}' \

-H 'Content-Type: application/json' \

-H 'Ocp-Apim-Subscription-Key: {subscriptions key}' \

-H 'Merchant-Serial-Number: {MSN}'

The endpoints have not changed. Please find them in the API specification.

10.4 Initiate test

- Fetch test merchant and test use

- GET access token

- GET subscriptionsProviderId

- Create new agreement

FAQ

1. How will the migration of data work?

Vipps MobilePay will make sure that all needed data is migrated from Subscriptions to Recurring:

All active merchants and their payment points will be migrated to the new system. The primary identifiers are

provider_id,agreement_id,payment_id, andrefund_id. These remain unchanged; there is no changes there.All partners/integrators will be created in the new system.

We will make sure that proper connection of merchant and partner/integrator is maintained on the new setup.

We will migrate all active agreements. There is no need to recreate agreements from NewWalletLaunch neither from reintegration.

All payment requests with due dates will be migrated and executed on new system.

We will migrate 3 years of historical production data (agreements, payment requests, refunds) to the new environment.

If you have a need to have a list of old and new ID's, we have an endpoint for obtaining agreements that offers both ExternalId and AgreementUuid.

Please refer to the NEW Recurring API endpoint description - You can utilize Agreement-v3-endpoints ListAgreementsV3 endpoint for mapping.

To be clear:

-Facade merchants: There will be not changes to the identifiers. The facade api will return the exact same identifiers. Below you can find information for when merchants will re-integrate to the NEW Recurring API Reference

providerid

There is no provider_id in the calls to Recurring API endpoints.

agreements

⚙️ Docs on agreements here:

GET Agreements endpoint

- Path parameters pageNumber and pageSize are no longer needed. Instead, use query parameter createdAfter.

GET Agreement endpoint

- Merchants can call GET agreement using either

agr_xxxxxxor theuuid. - We will return both

agreementId( "agr_xxxxxxx" format ) and auuid.

POST Agreement endpoint

- Field country_code becomes countryCode, and is not required.

- Field external_id becomes externalId, and is not nullable.

- Field description becomes productDescription, and has a maximum of 100 characters.

- Field frequency becomes interval. It is composed of 2 required fields :

- unit. Type : String. Value has to be among : "YEAR", "MONTH", "WEEK", "DAY".

- count. Type : Int. Value has to be between 1 and 31.

- Field mobile_phone_number becomes phoneNumber, and has a maximum of 15 characters.

- Field one_off_payment becomes initialCharge.

- Field plan becomes productName, and has a maximum of 45 characters.

- The following fields are not needed anymore :

- expiration_timeout_minutes

- links

- next_payment_date

- retention_period_hours

- disable_notification_management

- notifications_on

- The following fields are new :

- campaign

- pricing. Required field. Fields currency and amount are moved into this field.

- isApp

- merchantAgreementUrl. Required field.

- merchantRedirectUrl. Required field.

- scope

- skipLandingPage

charges

⚙️ Docs on charges here:

- id stays the same. charge.id = paymentId. chargeId = paymentid.

GET Charges endpoint

- New query parameter : status. It filters by status of the charge.

New endpoint : POST Charge endpoint

POST Charges endpoint :

- Amount has to be equal or superior to 100.

- Description has between 1 and 45 characters.

- Field due_date becomes due.

- Field grace_period_days becomes retryDays. Required field. Value is between 0 and 14.

- Field next_payment_date is no longer needed.

- New fields :

- transactionType. Required field. Type : String. Value has to be "DIRECT_CAPTURE" or "RESERVE_CAPTURE".

- orderId. Type : String.

refunds

⚙️ Docs on refunds here:

- Merchant will need to call the GET charge endpoint using the id of the charge refunded.

- Refunds won't have their own ids.

- Fields "amount" and "description" are required.

- No externalId and no status_callback_url are needed.

- Amount has to be equal or superior to 100.

2. Does the Recurring API have callbacks?

Yes! webhooks

- Webhooks technical documentation

- Webhooks endpoint documentation Another method is polling.

- Polling guidelines)

Callbacks will work on the facade API.

3. How will I find data about my payments?

We will migrate 3 years of historical data (agreements, payment requests, refunds). You will be able to access that data though:

- API GET calls. For new and historical data.

- Though Merchant Portal. Just for new transactions done after Nordic Wallet Launch.

- Integrate it into the Report API. Read more here about transition period.