MobilePay Subscriptions

Developer Documentation

One-Off Payments

There are 3 flows a customer can pay for a product or a service with One-Off payments. You are able to:

- Flow 1: Create a new Agreement with an initial One-Off Payment.

- Flow 2: Customer can initiate and request arbitrary One-Off Payment payments on their existing Agreement.

- Flow 3: Merchants can send One-Off payment, which MobilePay will attempt to automatically reserve, without user’s confirmation

Note: One-off payments are charged when the customer manually swipes accept or auto_reserve field was set to true when one-off payment was requested.

One-off Payment will expire in 1 day (by default) if it is not accepted or rejected by the user during that time or automatic reservation failed and user didn’t take any action afterwards. The Merchant (or the integrator) will receive a callback when the One-Off Payment is expired.

Custom expiration time ranging from 1 minute to 18 weeks can be specified by providing expiration_timeout_minutes field.

Note: as an integrator, it is your responsibility to align with the Merchant on needs for the fields, since default expiration of 1 day does not suit all Merchant use cases.

Payment reservation appears on the user’s Activities List in the ‘Pending’ section in the MobilePay app. When the purchase is completed, the transaction is moved to the ‘Approved’ section in the MobilePay app.

One-off payment does not affect the frequency and grace period. So if you create an agreement with a one-off payment, you can request the first subscription payment whenever you want. You can also request a one-off payment on an existing agreement in between two subscriptions payments, and it will not be affected by the frequency.

Flow 1- Request One-Off Payment With a New Agreement

- Use this when the customer does not have an agreement already, and you need the customer to create an agreement and simultaneously pay for the service/product. This allows for products to be bundled with agreements as one transaction (for example a phone).

- When you create an agreement with a One-Off payment, and the user accepts the agreement, the payment will be created and reserved.

- Capture and Reserve is handled by the Merchant. Capture is done even if user is blocked after reservation. When the one-offpayment is processed, the payment will show up in the users’s activitylist in the MobilePay app.

Add a one_off_payment property to the POST /api/providers/{providerId}/agreements request payload if you want the agreement being activated only when the user is successfully charged an initial subscription amount.

{

"external_id": "AGGR00068",

"amount": "10",

"currency": "DKK",

"description": "Monthly subscription",

"frequency": 12,

"links": [

{

"rel": "user-redirect",

"href": "https://example.com/1b08e244-4aea-4988-99d6-1bd22c6a5b2c"

},

{

"rel": "success-callback",

"href": "https://example.com/1b08e244-4aea-4988-99d6-1bd22c6a5b2c"

},

{

"rel": "cancel-callback",

"href": "https://example.com/1b08e244-4aea-4988-99d6-1bd22c6a5b2c"

}

],

"country_code": "DK",

"plan": "Basic",

"expiration_timeout_minutes": 5,

"mobile_phone_number": "4511100118",

"one_off_payment":

{

"amount": "80",

"external_id": "OOP00348",

"description": "Down payment for our services",

"expiration_timeout_minutes": "1440"

}

}

Request parameters

| Parameter | Type | Required | Description | Valid values |

|---|---|---|---|---|

| one_off_payment | object | One-Off Payment details. | ||

| one_off_payment.amount | number(0.00) | required | One-Off Payment amount, which will be displayed for the user in the MobilePay app. | > 0.00, decimals separated with a dot. |

| one_off_payment.description | string(60) | required | Additional information provided by the merchant to the user, that will be displayed on the One-off Payment screen. Description is a short description of what the client is paying for. | |

| one_off_payment.external_id | string(64)* | required | One-Off Payment identifier on the merchant’s side. This will be included in the request body of the payment callback. The external_id is visible on the One-off Payment screen. | |

| one_off_payment.expiration_timeout_minutes | int | optional | One-Off Payment expiration timeout in minutes. | Min: 1, max: 181440 (18 weeks), default: 1440 (24 hours) |

* Recommendation for "external_id" is to use up to 30 symbols. For instant transfers "external_id" is used as payment reference and will be truncated down to 30 symbols if it contains more. Truncated payment reference will be visible in bank statement.

In this case the response of POST /api/providers/{providerId}/agreements will contain additional one_off_payment_id value - id of the newly requested One-Off Payment.

{

"id": "1b08e244-4aea-4988-99d6-1bd22c6a5b2c",

"one_off_payment_id": "2a5dd31f-32c1-4517-925f-9c60ba19f8ca",

"links": [

{

"rel": "mobile-pay",

"href": "https://<mobile-pay-landing-page>/?flow=agreement&id=1b08e244-4aea-4988-99d6-1bd22c6a5b2c&redirectUrl=https%3a%2f%2fwww.example.com%2fredirect&countryCode=DK&mobile=4511100118"

}

]

}

Flow 2 - Request One-off Payment on an Existing Agreement

Use a POST /api/providers/{providerId}/agreements/{agreementId}/oneoffpayments endpoint in order to charge your customer one time for extra services.

- Use case: When the customer alreadY has an active agreement and wants to order extra services/products. It is customer initiated, and the customer needs to swipe in the MobilePay app. It is not possible to capture expired payments.

- Capture and Reserve is handled by the Merchant. The Merchant needs to capture the payment, to avoid that the payment will end up as being expired. It is dependent on the merchant use case, how fast the Merchant wants to capture the One-Off payment. For example, a hotel may reserve a payment, then move the money when the guest checks out.

- Merchant uses Agreement ID to make the payment request, not the phone number.

The response of POST /api/providers/{providerId}/agreements/{agreementId}/oneoffpayments contains two values: a unique id of the newly requested One-Off Payment and a link rel = mobile-pay.

{

"id": "07b70fdd-a300-460d-9ba1-aee2c8bb4b63",

"links": [

{

"rel": "mobile-pay",

"href": "https://<mobile-pay-landing-page>/?flow=agreement&id=1b08e244-4aea-4988-99d6-1bd22c6a5b2c&oneOffPaymentId=07b70fdd-a300-460d-9ba1-aee2c8bb4b63&redirectUrl=https%3a%2f%2fwww.example.com%2fredirect&countryCode=DK&mobile=4511100118"

}

]

}

- The id value can be used on the merchant’s back-end system to map a one-off payment with a specific Subscription agreement on the merchant’s side, and subsequently to capture a requested One-Off Payment when MobilePay user accepts it.

- The link rel = mobile-pay hyperlink reference must be used to redirect the user automatically using an HTTP response 302 or 303. Once the user is redirected, the MobilePay app will be opened to confirm the One-off Payment. This applies only if

auto_reservefield is omitted or set to false.

Flow 3 - OneOff with Auto reserve

- The one-off payment without swipe is sent directly to the MobilePay app. There is no MobilePay landing page. If the payment is successful, then a push message is shown that the One-off without swipe/confirmation was successful.

- One Off without swipe is valid for One-Offs without new agreement.

When using one-off without swipe, the sliding part is ommited. There might still be issues with card, nemID and the user will get a push message about the failed payment. But until then, it is a reserved payment. Therefore, there is a possibility of a time gap.

- Merchant can send one-off payment, which MobilePay will attempt to automatically reserve, without user’s confirmation.

- Value: The customer does not need to swipe and the payment experience is seamless

Merchants who wants to use auto_reserve field feature, must apply for this in regards to the onboarding of Subscriptions. Merchants cannot use this feature without being pre-approved to do so.

Request parameters

| Parameter | Type | Required | Description | Valid values |

|---|---|---|---|---|

| amount | number(0.00) | required | One-off Payment amount, which will be displayed for the user in the MobilePay app. | > 0.00, decimals separated with a dot. |

| description | string(60) | required | Additional information provided by the merchant to the user, that will be displayed on the One-off Payment screen. | |

| external_id | string(64)* | required | One-off Payment identifier on the merchant’s side. This will be included in the request body of the payment callback. The external_id is visible on the One-off Payment screen. | |

| links | string | required | Link relation of the One-off Payment creation sequence. Must contain 1 value for user redirect. | |

| links[].rel | string | required | Link relation type. | user-redirect |

| links[].href | string | required | Link relation hyperlink reference. | https://<merchant’s url> |

| auto_reserve | boolean | optional | When this field is set to true, we will attempt to automatically reserve the payment without user’s interaction. If you do not wish payment to be automatically reserved, you can omit this field or set it to false. | true/false |

| expiration_timeout_minutes | int | optional | One-Off Payment expiration timeout in minutes. | Min: 1, max: 181440 (18 weeks), default: 1440 (24 hours) |

{

"amount": "80",

"external_id": "OOP00348",

"description": "Pay now for additional goods",

"links": [

{

"rel": "user-redirect",

"href": "https://example.com/1b08e244-4aea-4988-99d6-1bd22c6a5b2c"

}

],

"auto_reserve": true,

"expiration_timeout_minutes": "1440"

}

* Recommendation for "external_id" is to use up to 30 symbols. For instant transfers "external_id" is used as payment reference and will be truncated down to 30 symbols if it contains more. Truncated payment reference will be visible in bank statement.

One-Off payment screens

When auto_reserve field is set to true:

-

Failed

auto_reserveOneOff : If the payment fails, and if push messages is also turned off, then a one-off confirmation screen after log in (until session expires) is by displayed for the User. The user can retry the payment from the Confirmation screen. -

Successful

auto_reserveOneOff : If the payment is successful, then the user is presented with a reservation receipt.

Dual Device

Initiating a purchase of a product/service from a desktop (the other device) should end-up as

- one-off Payment Landing Page on Desktop and

- a push directly to MobilePay (push notification)

Callbacks

Once the one-off payment status changes from Requested to Reserved, Rejected or Expired, a callback will be done to the callback address, which is configurable via PATCH /api/providers/{providerId} with path value /payment_status_callback_url. The same way as with callbacks for regular payment requests.

| New Status | Condition | When to expect | Callback status | Callback status_text | Callback status_code |

|---|---|---|---|---|---|

| Reserved | The one-off payment was accepted by user or was automatically reserved with auto_reserve flag and money is reserved for you on his card. You can now capture the money. |

Right after payment was successfully reserved. | Reserved | Payment successfully reserved. | 0 |

| Rejected | User rejected one-off payment request in MobilePay. | Right after user rejects one-off payment. | Rejected | Rejected by user. | 50001 |

| Expired | 1. One-off payment was neither accepted, nor rejected by user. 2. User didn’t any action after automatic reservation failed. |

1 day after you requested one-off payment | Expired | Expired by system. | 50008 |

| Requested | The automatic reservation of one-off payment failed. User action is needed. | Right after the automatic reservation has failed | Requested | Automatic reservation failed. User action is needed. | 50013 |

Callbacks about OneOff and Agreement

You will get callbacks about the payment to your callback address. Moreover, you will get callbacks about the agreement to either success or failure url, that you have set upon agreement creation. However, unless one-off payment automatic reservation fails, you will not get callbacks for either, before their status changes. So you should expect a callback when the agreement is accepted / rejected / expired and a callback when the OneOff is either accepted/rejected/expired. If one-off payment’s automatic reservation fails, then the status of the one-off payment will not change, but a callback about the event will be sent.

The response for agreement creation on the other hand, consist of both agreement and OneOff.

One-off callback body example

[

{

"agreement_id": "8380f9e4-10a6-4f6d-b2f4-cdb7f80a4d7f",

"payment_id": "022a08d8-73c6-4393-aeda-d0c8ae5172a5",

"amount": "19.45",

"currency": "DKK",

"payment_date": "2019-09-18",

"status": "Reserved",

"status_text": "Payment successfully reserved.",

"status_code": 0,

"external_id": "3280100",

"payment_type": "OneOff"

}

]

User notifications

| Description | When | Text | Buttons | Depends on these Notification settings | Type |

|---|---|---|---|---|---|

| Dual Device only: One-off payment on existing agreement | When customer is purchasing on existing agreement. | Godkend betaling på [Amount] [Currency] til [Merchant] | Text: Vis Navigation: Payment Overview | OS, App | OneOff |

| One-off without swipe | When One-off without swipe/confirmation was successful | Betalt [Amount] [Currency] til [Merchant Name] | Text: Vis Navigation: Reservation receipt or Success receipt | OS, App | One-off |

| One-off without swipe/confirmation was NOT successful | When One-off without swipe/confirmation was NOT successful | Vi kunne ikke gennemføre din betaling til [Merchant] | Text: Vis Navigation: One-off confirmation screen | OS, App | One-off |

If the user has turned of Push Notifications, then the only way the user can see the payment is by opening the in activity list or agreement payments.

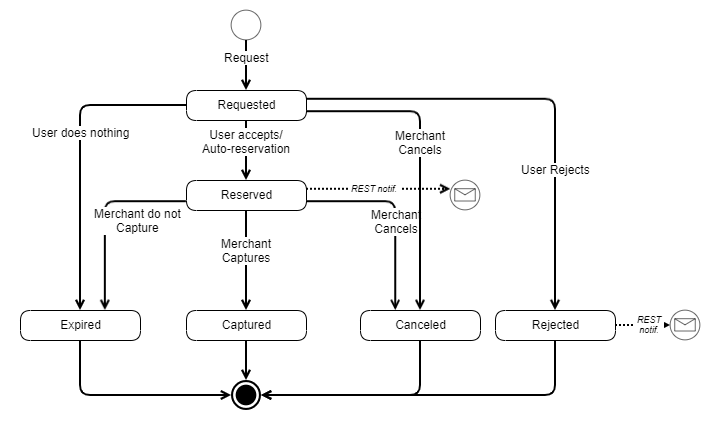

One-off payment state diagram

Capture Reserved One-Off Payment

When you receive a callback about successfully reserved payment, now it’s time to capture your money. You can do that by making a call to POST /api/providers/{providerId}/agreements/{agreementId}/oneoffpayments/{paymentId}/capture endpoint. If the HTTP response is 204 - No Content, it means that the money was transfered to your account.

You can capture a payment only once for an order, and the payment can’t be more than the order’s authorized amount. This means that your customers can’t add to an existing order. If they want to add more products after an order has been placed, then they need to make a new order.

Cancel One-Off Payment Request/Reservation

In case you weren’t able to deliver goods or any other problem occur, you can always cancel one-off payment until it’s not captured or expired. You can do that by making a call to DELETE /api/providers/{providerId}/agreements/{agreementId}/oneoffpayments/{paymentId} endpoint. If the HTTP response is ‘204 - No Content’, it means that one-off payment request/reservation was canceled.

The enduser cannot cancel the agreement with a pending payment reservation, only the merchant can do so.

By cancelling the agreement with a pending payment reservation, then the merchant also automatically cancels the reservation

Expired one-off

It is mandatory for the merchant to Capture or Cancel one-off payment if it was reserved on a customer account.

We encourage you to capture as soon as a service is rendered or order shipped. It results in bad end-user experience, if the amount is reserved on the customer’s account for too long, as the customer can see the amount on their bank statement.

Uncaptured one-off payments expire after 7 days.